Distance selling rules

Distance selling rules have changed. As of July 1, 2021, the MOSS scheme (Mini One Stop Shop) that started Jan. 1, 2015, has been converted to the OSS scheme. With this, the tax authorities within Europe have decided that it has been a successful test to deal harmoniously within Europe with all the VAT regulations that apply.

The rules

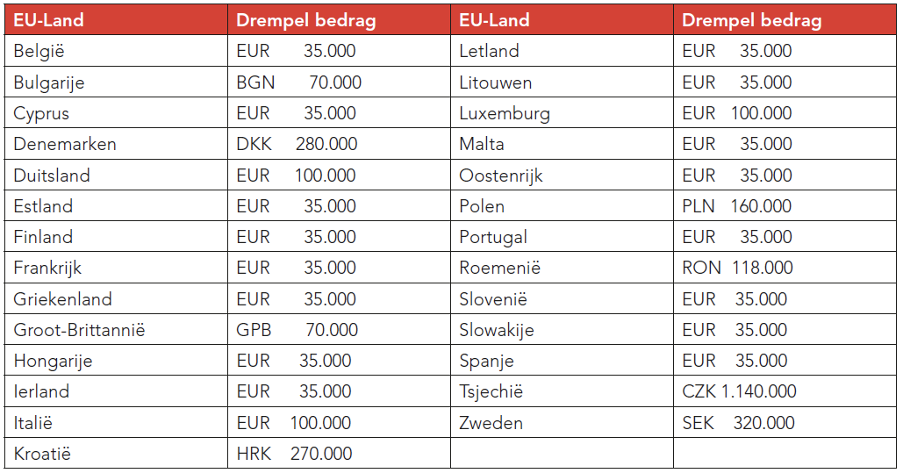

Until July 1, 2021, for all distance sales, i.e. all sales to consumers in other EU countries, you could choose to directly apply the sales tax rate of a relevant country and declare there, or charge Dutch VAT up to the threshold amount. Below is the table that applied. In it you can see that the amounts do not uniformly match and some countries choose to make the threshold a bit higher. With or without a threshold, once you had to file a tax return in another European country, the necessary administrative work was involved.

The average turnaround time for a VAT registration ranged from 6 weeks to 3 months. In addition, countries such as Spain and Italy used a domestic agent which again involved time and money.

The change

Within Europe it has long been known that this form of tax differentiation leads to an enormous amount of bureaucracy, just as it did in the days when the customs system still applied within Europe. Because of the differences within the various countries for both tax rules and application of the different tax rates, a test was started that was strictly applied to all telecommunications, broadcasting and electronic services. A characteristic of this group of services is that they are mostly automated and require very little human intervention. Within the 2019 Tax Plan, it is included for the first time that the test has been perceived as successful in 3 years and an extension will take place to the other categories of taxes.

What can OSS do for me?

Above all, the OSS scheme can make your life a lot easier. When a country is up and running and turnovers are relatively low, it is incredibly annoying to have to spend hundreds of dollars for an authority to declare your sales tax in that particular country.

Overview of VAT rates in Europe

| Country | Standard rate | Reduced rate | Country | Standard rate | Reduced rate |

| Belgium | 21% | 6%, 12% | Luxembourg | 17% | 3%, 8% |

| Bulgaria | 20% | 9% | Malta | 18% | 5%,7% |

| Cyprus | 19% | 5%, 9% | Moldova | 20% | 8% |

| Denmark | 25% | – | Netherlands | 21% | 9% |

| Germany | 19% | 7% | Austria | 20% | 10%,13% |

| Estonia | 20% | 9% | Poland | 23% | 5%,8% |

| Finland | 24% | 10%, 14% | Portugal | 23% | 6%,13% |

| France | 20% | 2,1 %, 5,5%,10% | Romania | 19% | 5%,8% |

| Greece | 24% | 6%, 13% | Russia | 18% | 10% |

| Hungary | 27% | 5%, 18% | Slovakia | 20% | 10% |

| Ireland | 23% | 4,8%, 9%, 13,5% | Slovenia | 22% | 5%,9,5% |

| Italy | 22% | 4,8%, 5%, 10% | Spain | 21% | 4%,10% |

| Croatia | 25% | 5%, 13% | Czech Republic | 21% | 10%,15% |

| Latvia | 21% | 5%, 12% | Turkey | 18% | 1%,8% |

| Lithuania | 21% | 5%, 9% | Sweden | 25% | 6%,12% |

What are additional issues that are important to OSS?

There are a number of things to keep in mind, but for which you will also be handed a number of charters.

I am in doubt about my services and the VAT rate associated with them?

For that, check out the European Union's VAT option scheme.

There you can arrive at an answer by country with a number of questions.

I am expecting a VAT refund in the european country where I will be doing business. This arrangement has not changed much from the past. Make sure you can fill in all details before October 1 (including the invoices to be sent with a document set up for the total refund). The Dutch Tax Administration will forward this request and will assess per country whether the request meets the conditions. Therefore also take into account a longer waiting period. Additional explanations can be found here.

Are you dealing with a special rate that will not apply uniformly in every country?

If so, always have an experienced Tax Analyst educate you properly. It could just be that your assumption is incorrect causing you to misunderstand a foreign benefit which could result in a lost opportunity.

Our experience

We welcome the OSS scheme with open arms. It puts an end to an awful lot of bureaucracy that has made doing business within Europe easier. This makes competition within Europe more transparent and perhaps opens the doors in which a European product platform is a next step.

Would you also like to start a beautiful and above all easy to find webshop? Then get in touch with us!